45 yield to maturity coupon bond

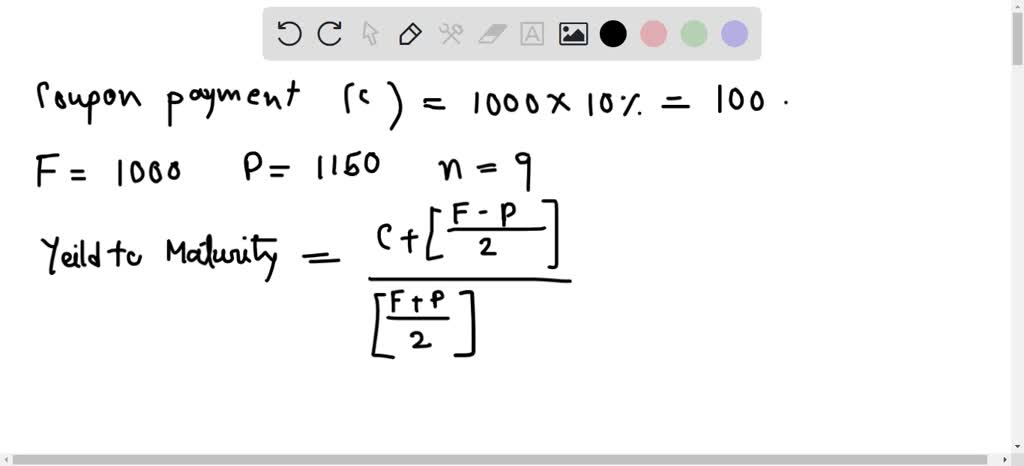

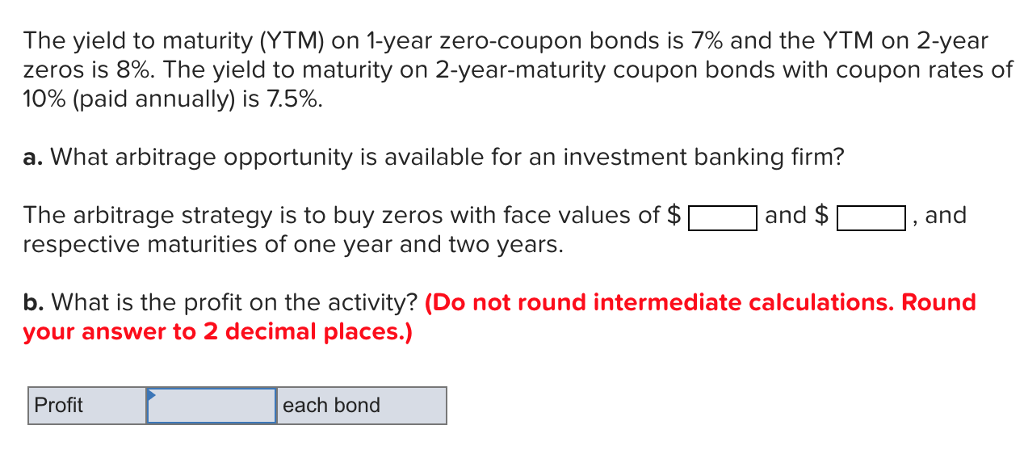

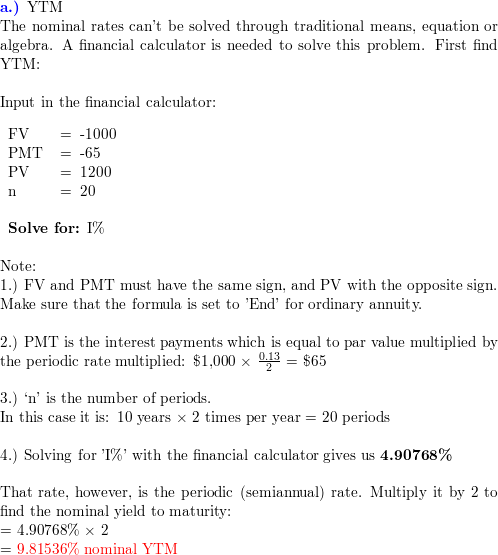

Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments r = discount rate (the yield to maturity) F = Face value of the bond n = number of coupon payments Yield to Maturity - Approximate Formula (with Calculator) The price of a bond is $920 with a face value of $1000 which is the face value of many bonds. Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be. After solving this equation, the estimated yield to maturity is 11.25%.

Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM.

Yield to maturity coupon bond

How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow Yield to Maturity (YTM) for a bond is the total return, interest plus capital gain, obtained from a bond held to maturity. It is expressed as a percentage and tells investors what their return on investment will be if they purchase the bond and hold on to it until the bond issuer pays them back. Current Yield vs. Yield to Maturity: What's the Difference? Current yield measures the income of a bond as a percentage of the purchase price. If the bond is purchased at a discount, the current yield is higher than the coupon rate, and lower than yield to maturity. If the bond is purchased at a premium, the current yield is lower than the coupon rate and higher than the yield to maturity. 1. Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

Yield to maturity coupon bond. Bond Yield: Formula and Percent Return Calculation - Wall Street … VerkkoCalculating the current yield of a bond is a three-step process: Step 1: The current bond price can be readily observed in the markets – in which the bond can either trade at a discount, at par or at a premium to par.; Step 2: The annual coupon is a function of the bond’s coupon rate, par value, and payment frequency – and, if applicable, the … Yield to Maturity vs. Coupon Rate: What's the Difference? Verkko20.5.2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... What Is the Difference Between Coupon Rate and Yield-To-Maturity ... Coupon rate is expressed as the percentage (per annum basis) of the face value of the bond. It is the amount that the bondholders will receive for holding the bond. Coupon payments are usually made semi-annually or quarterly. Yield-to-maturity (YTM), as the name states, is the rate of return that the investor/bondholder will receive, assuming ... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia If a bond's purchase price is equal to its par value, then the coupon rate, current yield, and yield to maturity are the same. 1 When discussing bonds, it is important to note the many...

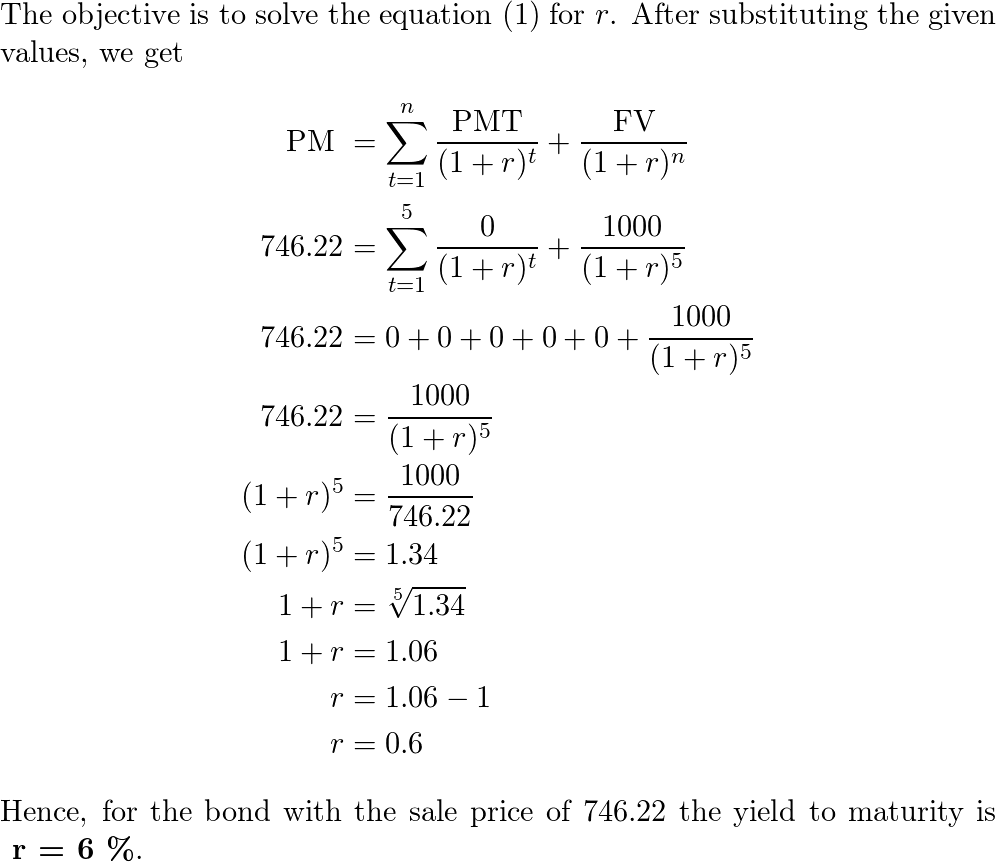

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600 Yield to Maturity (YTM): What It Is, Why It Matters, Formula Verkko31.5.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity is what the investor can expect to earn from the bond if they hold it until maturity. Do the Math Prices and yields move in opposite directions. A little math can help you further understand this concept. Let's stick with the example from above. The yield increases from 2% to 4%, which means that the bond's price must fall. Solved The yield to maturity of a $1,000 bond with a | Chegg.com You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer. The yield to maturity of a $1,000 bond with a 7.1% coupon rate, semiannual coupons, and two years to maturity is 7.9% APR, compounded semiannually. What is its price?

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Here's another example that clearly ... Solved You find a zero coupon bond with a par value of | Chegg.com Finance questions and answers. You find a zero coupon bond with a par value of $10,000 and 24 years to maturity. If the yield to maturity on this bond is 4.2 percent, what is the price of the bond? Assume semiannual compounding periods. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at a discount which represents a larger share of the purchase price. 5. [Solved] Find the yield to maturity on a semiannual coupon bond given ... Find the yield to maturity on a semiannual coupon bond given that... Find the yield to maturity on a semiannual coupon bond given that the bond price is $1128, the coupon rate is 8%, the face value is $1000, and which matures in 13 years. (Do not use % sign with your answer). Business Finance.

Interest Rate Statistics | U.S. Department of the Treasury VerkkoNOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from …

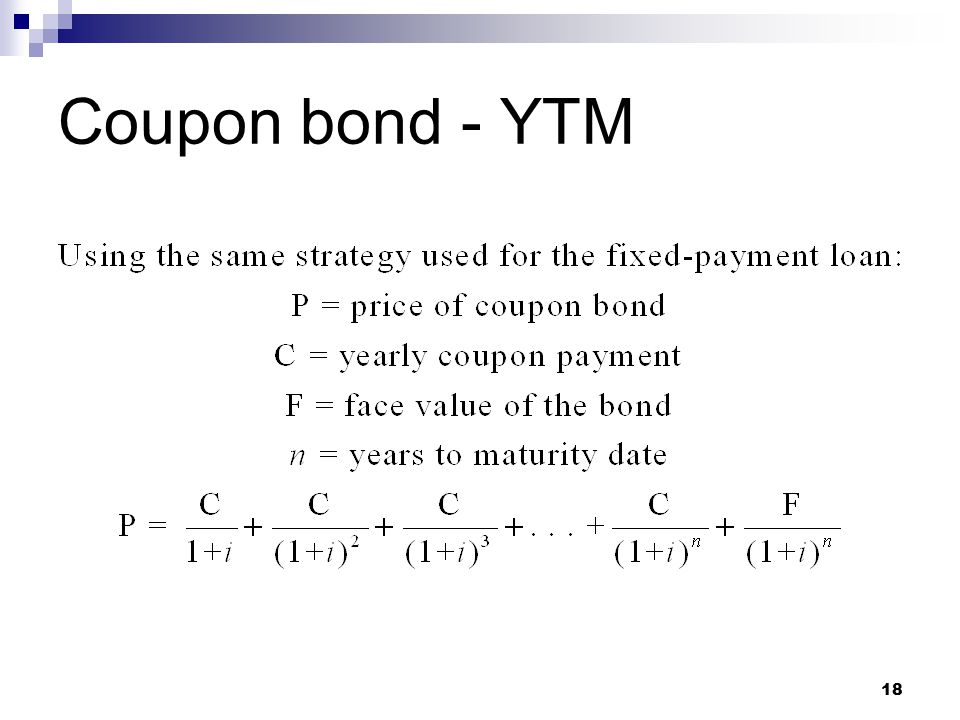

Yield to Maturity Calculator | Good Calculators VerkkoP is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ...

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Yield to maturity is the effective rate of return of a bond at a particular point in time. On the basis of the coupon from the earlier example, suppose the annual coupon of the bond is $40. And the price of the bond is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic

Yield to maturity - Wikipedia VerkkoThen continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds

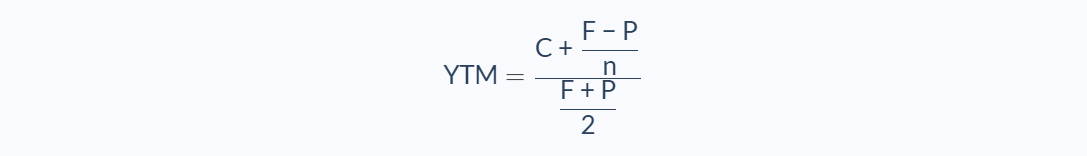

Yield to Maturity (YTM) - Definition, Formula, Calculation Examples Yield to Maturity Formula = [C + (F-P)/n] / [ (F+P)/2] Where, C is the Coupon. F is the Face Value of the bond. P is the current market price. n will be the years to maturity. You are free to use this image on your website, templates, etc, Please provide us with an attribution link The formula below calculates the bond's present value.

Bonds Flashcards | Quizlet The yield to maturity on this bond is A. 8.0%. B. 8.3%. C. 9.0%. D. 10.0%. E. None of the options C. 9.0% When a bond sells at par value, the coupon rate is equal to the yield to maturity A coupon bond that pays interest annually has a par value of $1,000, matures in five years, and has a yield to maturity of 10%.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... VerkkoCalculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

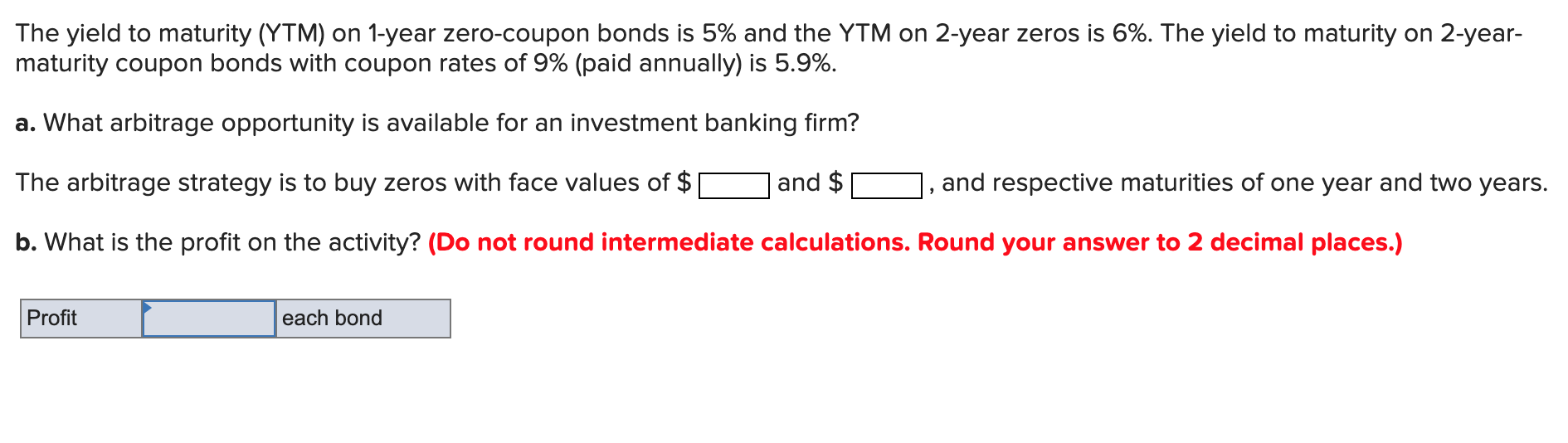

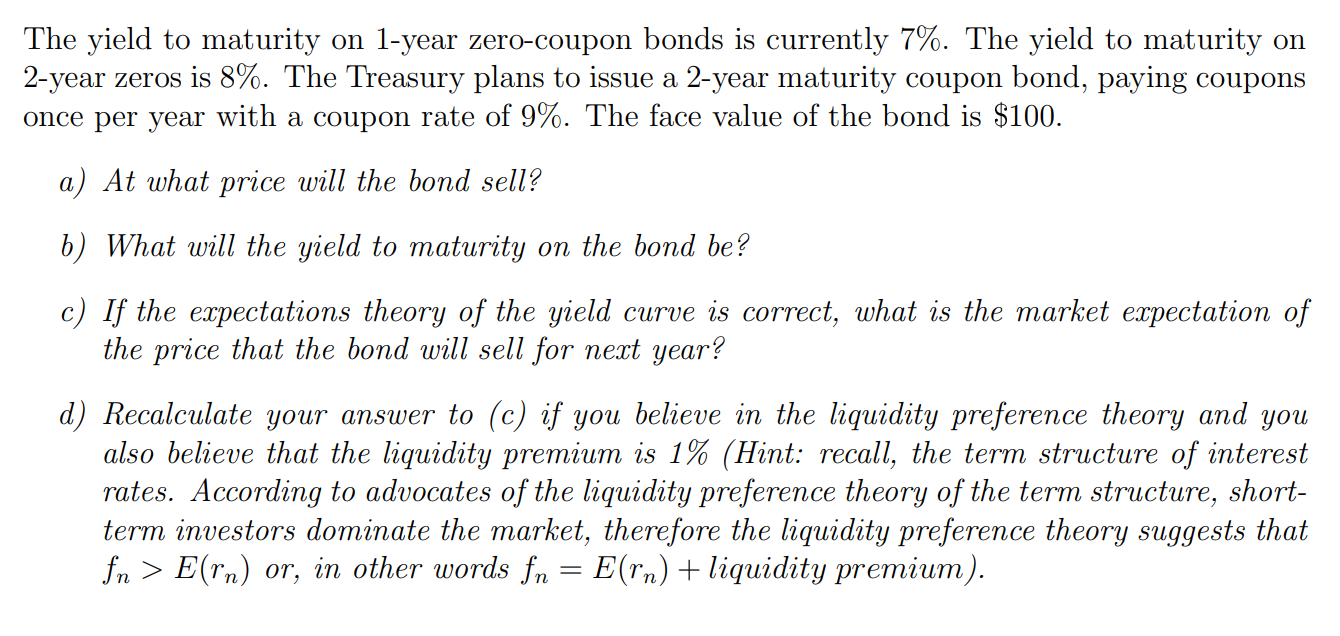

Solved The yield to maturity on 1-year zero-coupon bonds is | Chegg.com The yield to maturity on 1-year zero-coupon bonds is currently 6%; the YTM on 2-year zeros is 7%. The Treasury plans to issue a 2-year maturity coupon bond, paying coupons once per year with a coupon rate of 8.5%. The face value of the bond is $100. a. At what price will the bond sell? (Do not round intermediate calculations.

Understanding Coupon Rate and Yield to Maturity of Bonds The Yield to Maturity is a rate of return that assumes that the buyer of the bond will hold the security until its maturity date and incorporates the rise or fall of market interest rates. This will be a bit technical. Let's see what happens to your bond when interest rates in the market move.

Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures.

Bond Yield Formula | Step by Step Calculation & Examples VerkkoAnd the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate ... frequency of payment, and amount value at maturity. Step 1: Calculation of the coupon payment annual payment. Annual Coupon Payment = Face Value * Coupon Rate =$1300*6% Annual Coupon Payment …

How to Calculate Yield to Maturity of a Zero-Coupon Bond Verkko10.10.2022 · Yield to maturity (YTM) tells bonds investors what their total return would be if they held the bond until maturity. YTM takes into account the regular coupon payments made plus the return of ...

Bond Yield - Cbonds.com Yield to maturity (annually compounded yield to maturity, YTM (YTP/YTC)) is the annually compounded rate of return regardless of a bond's coupon period. This approach is used to calculate yields in Russian, Japanese, Norwegian, Italian, Danish, Swedish, and Spanish markets as well as a number of other countries.

A 13.75-year maturity zero-coupon bond selling at a | Chegg.com A 13.75-year maturity zero-coupon bond selling at a yield to maturity of 9% (effective annual yield) has convexity of 150.3 and modified duration of 11.9 years. A 25-year maturity 5\% coupon bond making annual coupon payments also selling at a yield to maturity of 9% has nearly identical duration-11.80 years - but considerably higher convexity of 232. a.

Calculate the YTM of a Coupon Bond - YouTube Calculate the YTM of a Coupon Bond 16,902 views Jul 25, 2018 68 Dislike Share Save Michael Padhi 631 subscribers This video explains the meaning of the yield to maturity (YTM) of a coupon...

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

Current Yield vs. Yield to Maturity: What's the Difference? Current yield measures the income of a bond as a percentage of the purchase price. If the bond is purchased at a discount, the current yield is higher than the coupon rate, and lower than yield to maturity. If the bond is purchased at a premium, the current yield is lower than the coupon rate and higher than the yield to maturity. 1.

How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow Yield to Maturity (YTM) for a bond is the total return, interest plus capital gain, obtained from a bond held to maturity. It is expressed as a percentage and tells investors what their return on investment will be if they purchase the bond and hold on to it until the bond issuer pays them back.

A European bond has a par value of 1000 Euros, a coupon rate of 4.5 percent and a yield to maturity of 3.2 percent. The bond has 19 years to maturity. Coupons are made annually. What is the value of ...

:max_bytes(150000):strip_icc()/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

Post a Comment for "45 yield to maturity coupon bond"