43 coupon rate semi annual

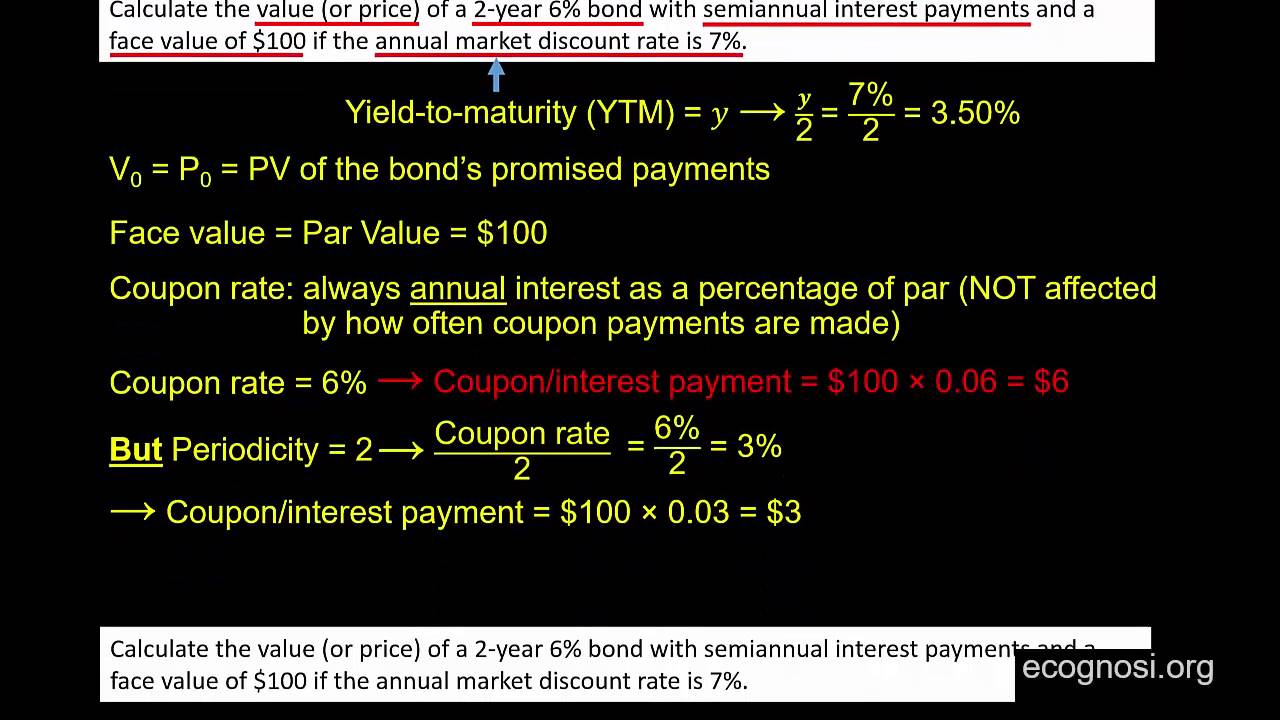

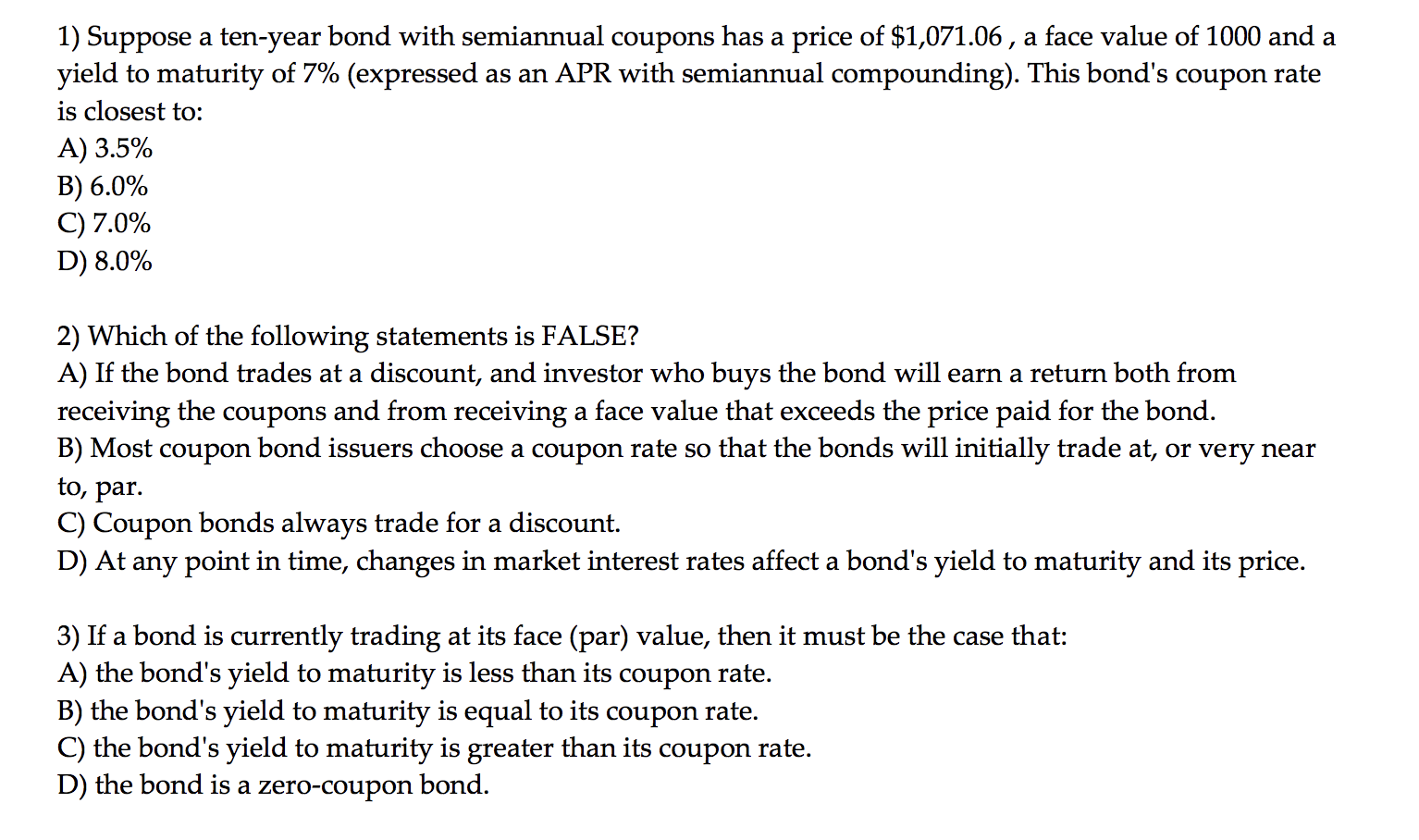

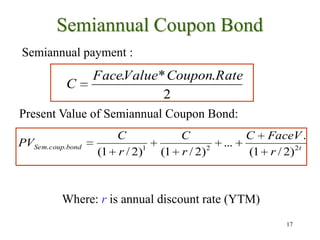

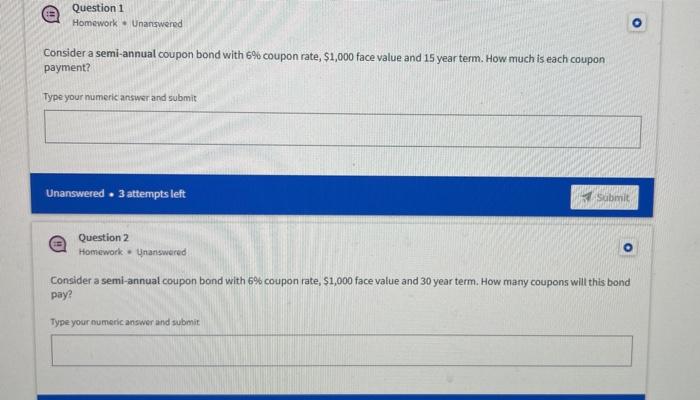

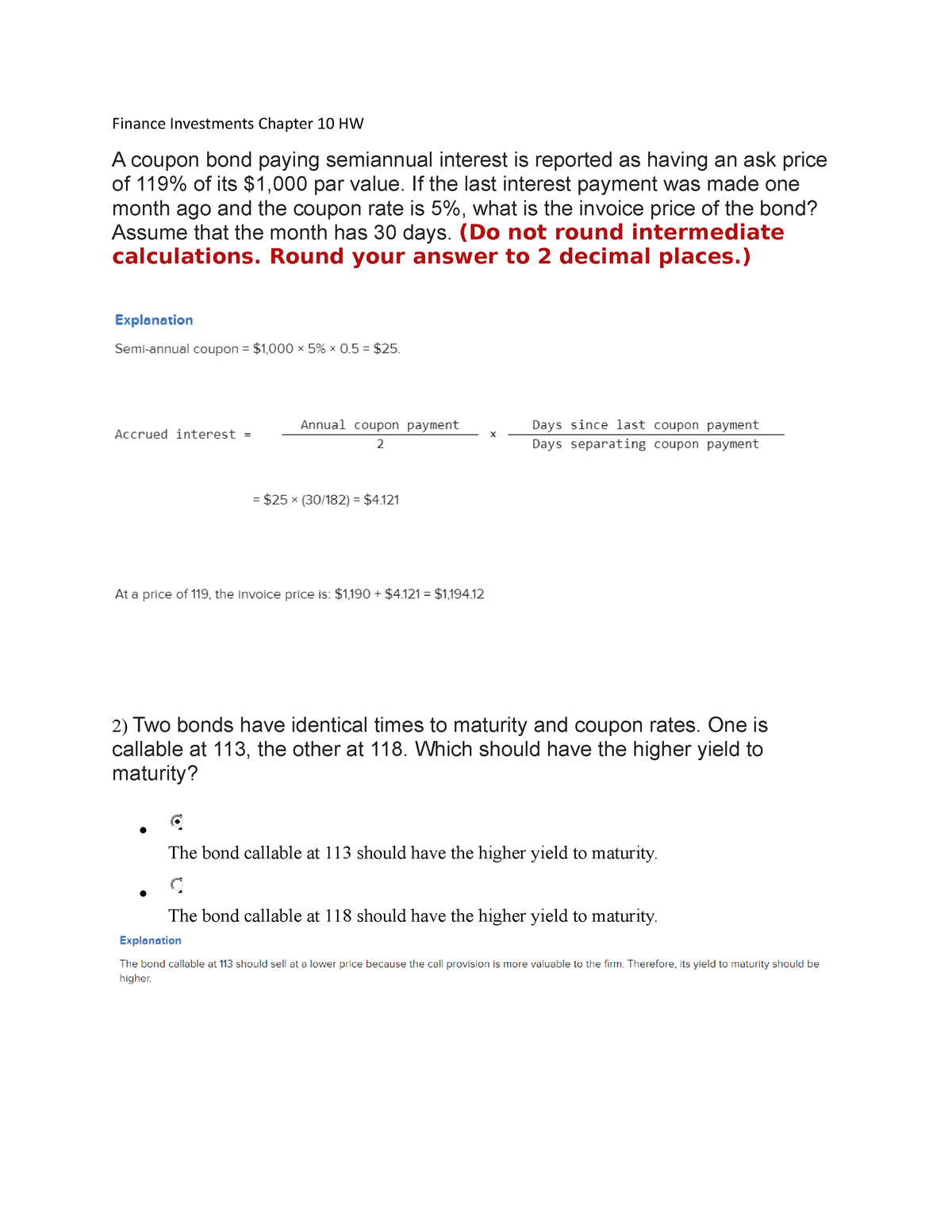

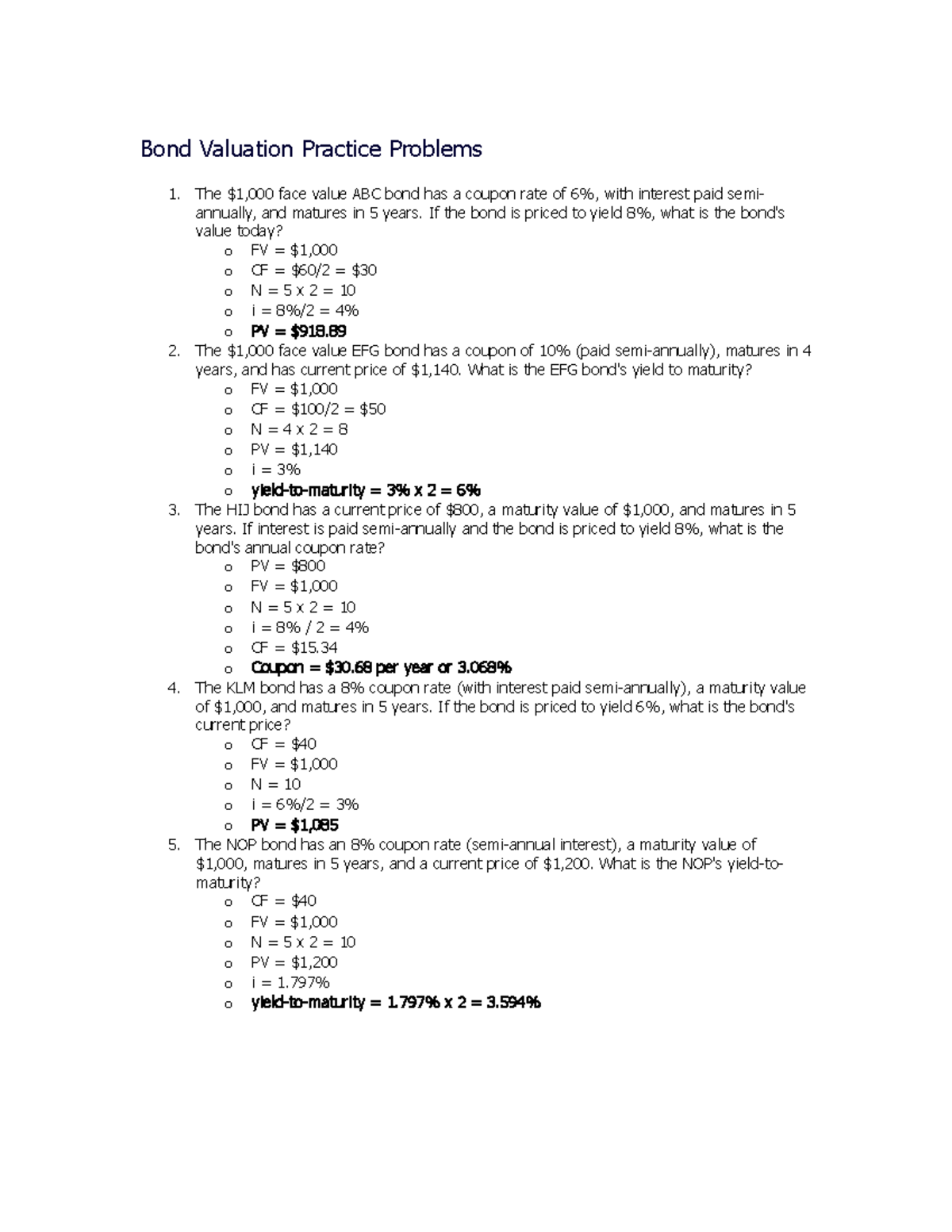

Coupon Rate Definition - Investopedia For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with higher coupon rates are more desirable... Coupon Rate: Formula and Bond Calculation - Wall Street Prep Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k each year for as long as the bond is still outstanding. Number of Periods (N) = 2 Coupon Payment = $6,000 / 2 = $3,000 Bond Coupon Payment Calculation Steps

$10 Off Bath & Body Works Coupons, Promo Codes 2022 Annual Sales Bath & Body Works runs annual sales every year during Cyber Monday and Black Friday. There are also semi-annual sales in January and June with the chance to save up to 65% off. Shop during Candle Day held every year in December. The prices on three-wick and larger candles drop to less than $10 each. Bath & Body Works Black Friday ...

Coupon rate semi annual

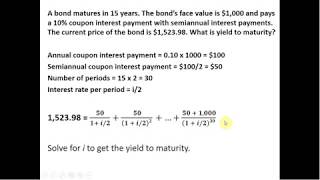

Coupon Payment Calculator Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.. You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · Microsoft is quietly building an Xbox mobile platform and store. The $68.7 billion Activision Blizzard acquisition is key to Microsoft’s mobile gaming plans. Calculate The YTM Of A Bond With Semi Annual Coupon Payments ... - YouTube The yield to maturity is the rate of return of a bond. In our example, we know that the par value is £1,000, the coupon rate is 6%, there are 5 years to matu...

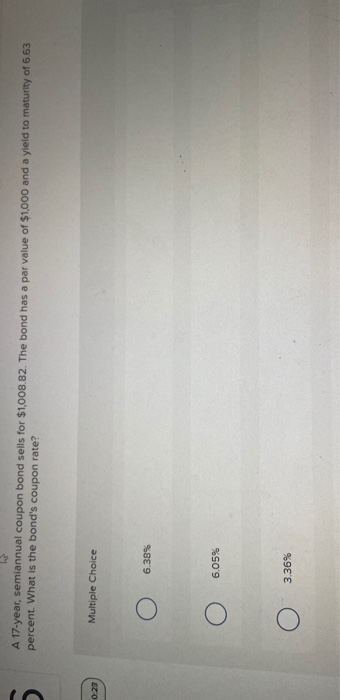

Coupon rate semi annual. Semi-Annual Coupon Note Definition | Law Insider Zero Coupon Note means a Note specified as such in the relevant Final Terms. Semi-Annual Period means each of: the period beginning on and including January 1 and ending on and including June 30; and the period beginning on and including July 1 and ending on and including December 31. Fixed Rate Note means a Note on which interest is calculated ... Semiannual coupon and annual coupon | Forum | Bionic Turtle So the rate is 5% per semiannual period which is used to pay coupon at end of each half year. so that for a bond with face value 100 with 10% semiannual couponsmeans that coupons are paid semiannually (at end of each half year) at 10/2%=5% which is (5/100)*100=5 , so the semiannual coupon is 5% because the rate 10% is compounded semiannually. Semi-Annual Coupon Rate Definition | Law Insider Related to Semi-Annual Coupon Rate Semi-Annual Period means each of: the period beginning on and including January 1 and ending on and including June 30; and the period beginning on and including July 1 and ending on and including December 31. Coupon Rate has the meaning set forth in Section 2.8. Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon...

Hotels: Search Cheap Hotels, Deals, Discounts, Accommodations ... Get a link to download the app in the Apple App Store or Google Play Store. 1 message per request. Message and data rates may apply. Text HELP for help or STOP to unsubscribe. CBS Los Angeles - Breaking Local News, Weather & Investigations CBS News Live CBS News Los Angeles: Local News, Weather & More Jun 10, 2019; CBS News Los Angeles Coupon Rate of a Bond - WallStreetMojo Annual interest payment = Periodic interest payment * No. of payments in a year. Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100%, as shown below. Examples Let us take the example of a bond with quarterly coupon payments. Website Builder App for Windows and Mac - MOBIRISE MOBIRISE WEB BUILDER Create killer mobile-ready sites! Easy and free. Download Mobirise Website Builder now and create cutting-edge, beautiful websites that look amazing on any devices and browsers.

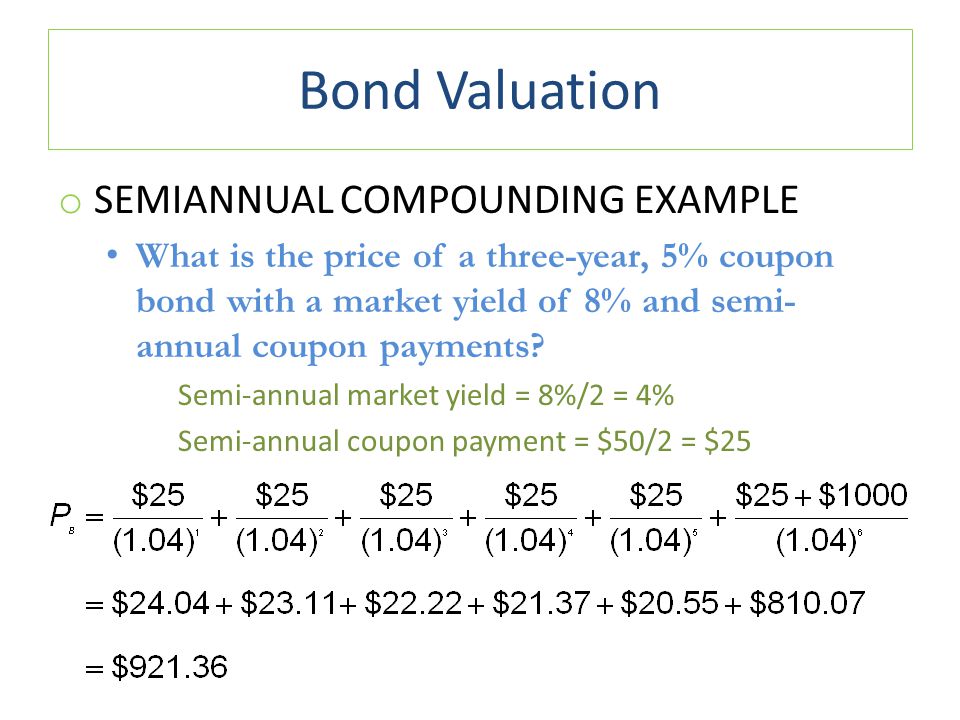

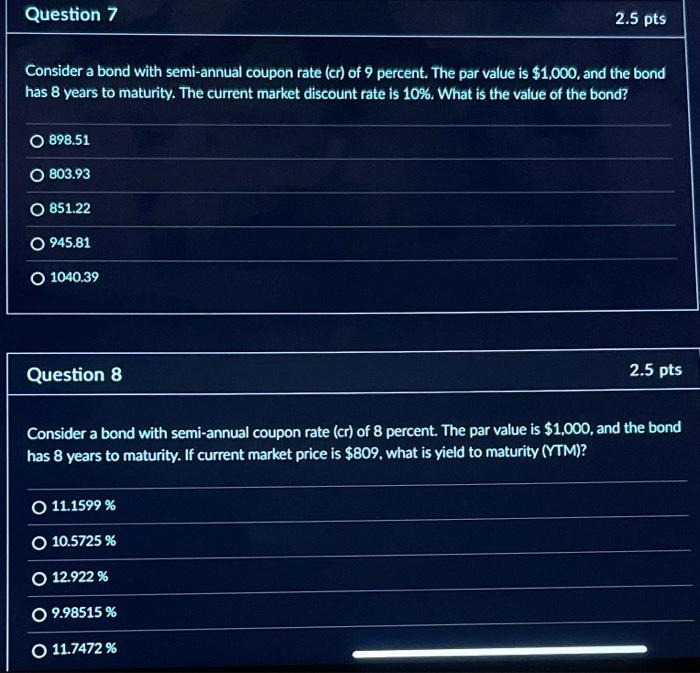

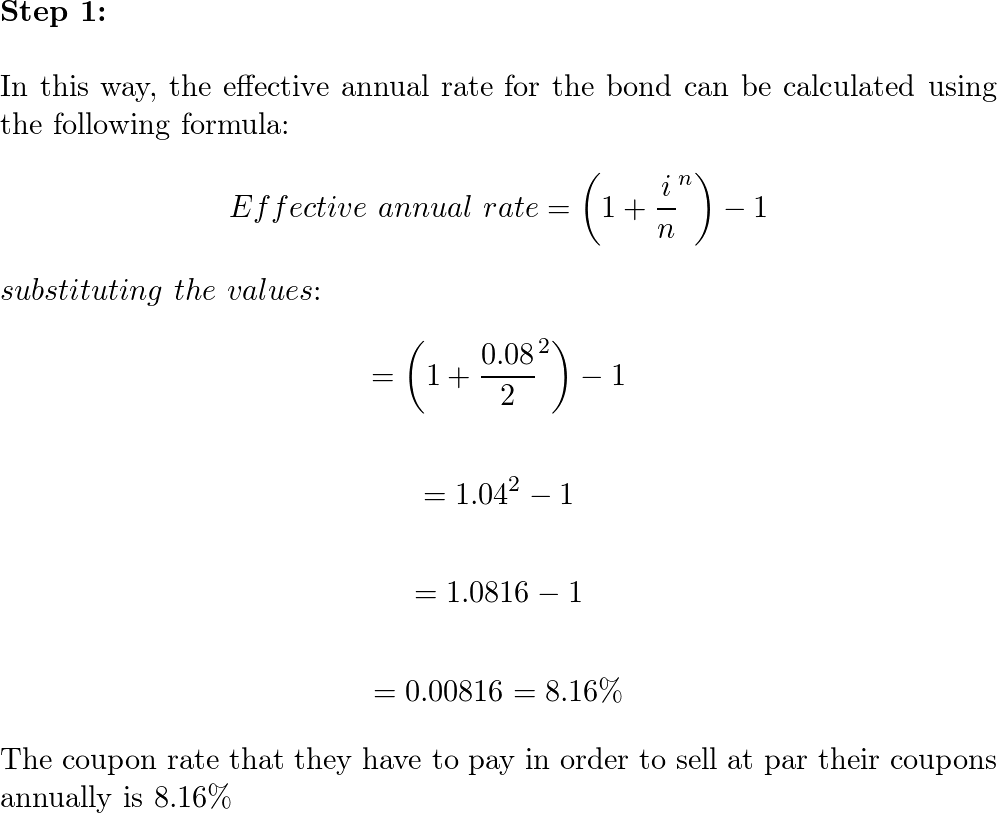

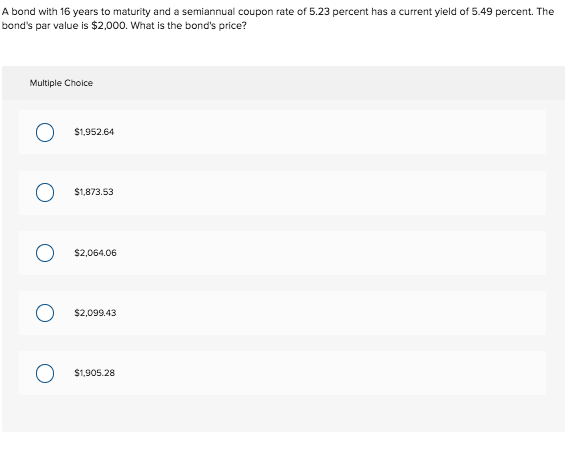

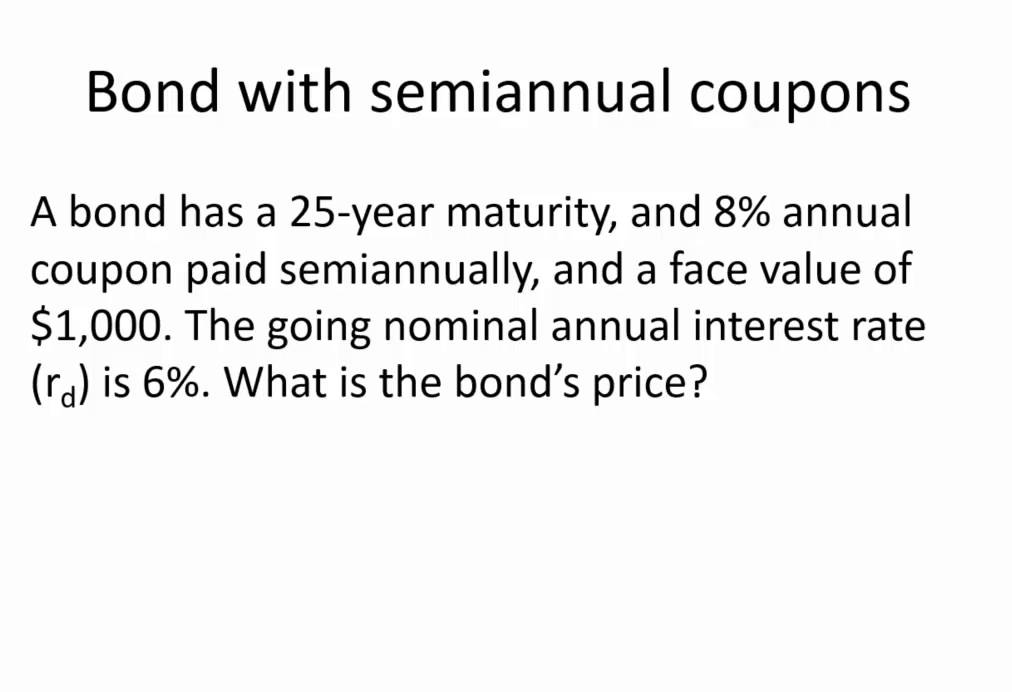

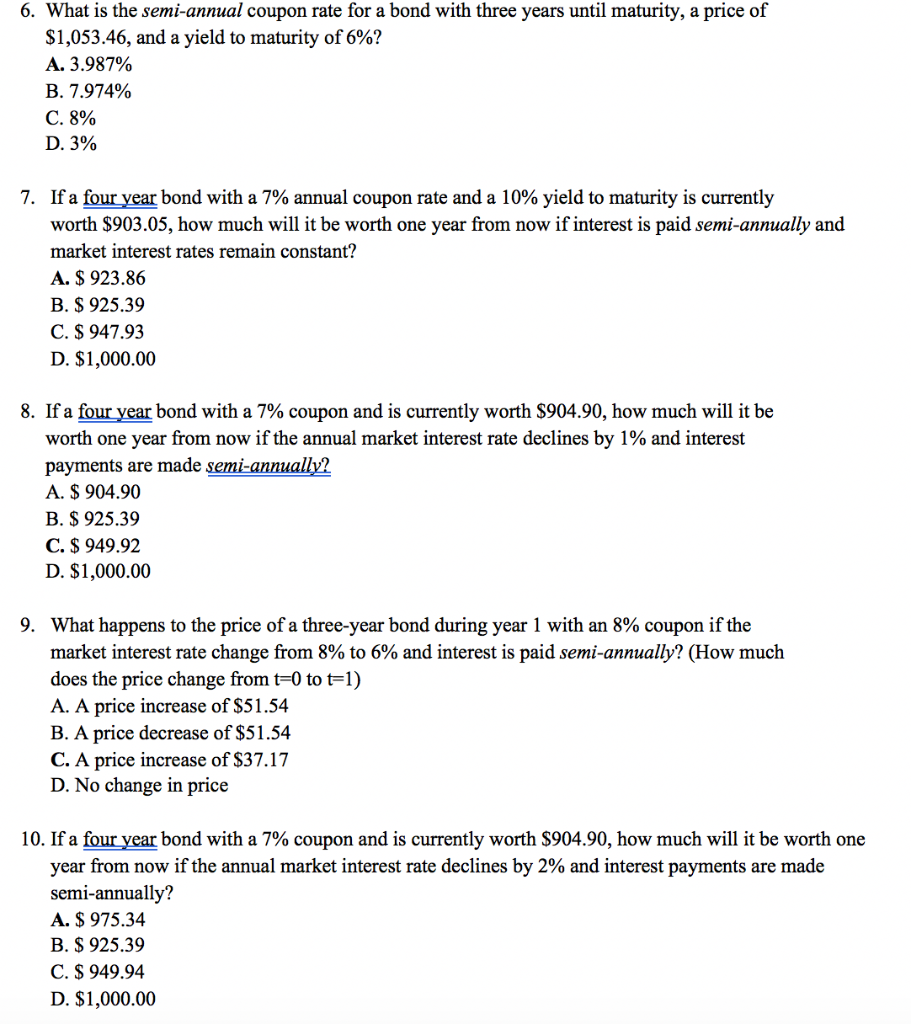

How to Calculate the Price of a Bond With Semiannual Coupon Interest ... Therefore, you would use 5 percent as your required rate of return. Converting Payment Periods Because semiannual coupon payments are paid twice per year, your required rate of return, mathematically speaking, must be cut in half. Therefore, the example's required rate of return would be 2.5 percent per semiannual period. Coupon Rate Formula | Step by Step Calculation (with Examples) Dave said that the coupon rate is 10.00% Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct. A diff 2 page ref 251 keywords coupon rate semiannual Diff: 2 Page Ref: 246 Keywords: Intrinsic Value, Semiannual Interest, Required Return, Coupon Rate Learning Obj.: L.O. 7.6 AACSB: Analytical Thinking 18) Andre owns a corporate bond with a coupon rate of 8% that matures in 10 years. Ruth owns a corporate bond with a coupon rate of 12% that matures in 25 years. If interest rates go down, then A) the value of Andre's bond will decrease and the ... How to Calculate Semi-Annual Bond Yield | The Motley Fool Its coupon rate is 2% and it matures five years from now. To calculate the semi-annual bond payment, take 2% of the par value of $1,000, or $20, and divide it by two. The bond therefore...

Solved Suppose a ten-year, bond with an coupon rate and - Chegg Expert Answer. 86% (7 ratings) Transcribed image text: Homework: Assignment 6 (Chapter 6) Score: 0 of 1 pt 1 8 of 10 (6 complete) P 6-12 (similar to) Suppose a ten-year $1,000 bond with an 8.3% coupon rate and semiannual coupons is trading for $1,034.89. a.

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity

Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%.

Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value.

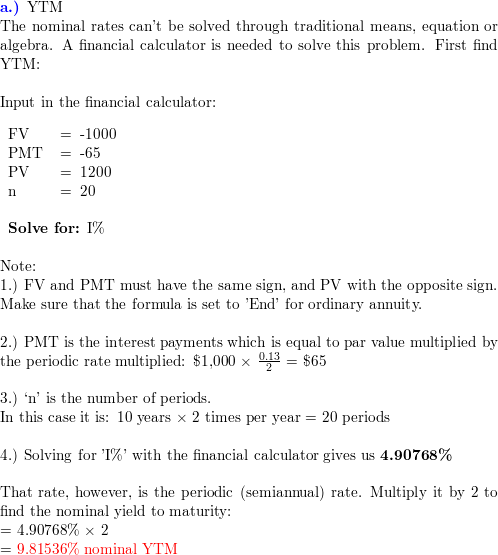

Calculate The YTM Of A Bond With Semi Annual Coupon Payments ... - YouTube The yield to maturity is the rate of return of a bond. In our example, we know that the par value is £1,000, the coupon rate is 6%, there are 5 years to matu...

Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · Microsoft is quietly building an Xbox mobile platform and store. The $68.7 billion Activision Blizzard acquisition is key to Microsoft’s mobile gaming plans.

Coupon Payment Calculator Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.. You can quickly calculate the coupon payment for each payment period using the coupon payment formula:

Post a Comment for "43 coupon rate semi annual"