40 bond yield vs coupon rate

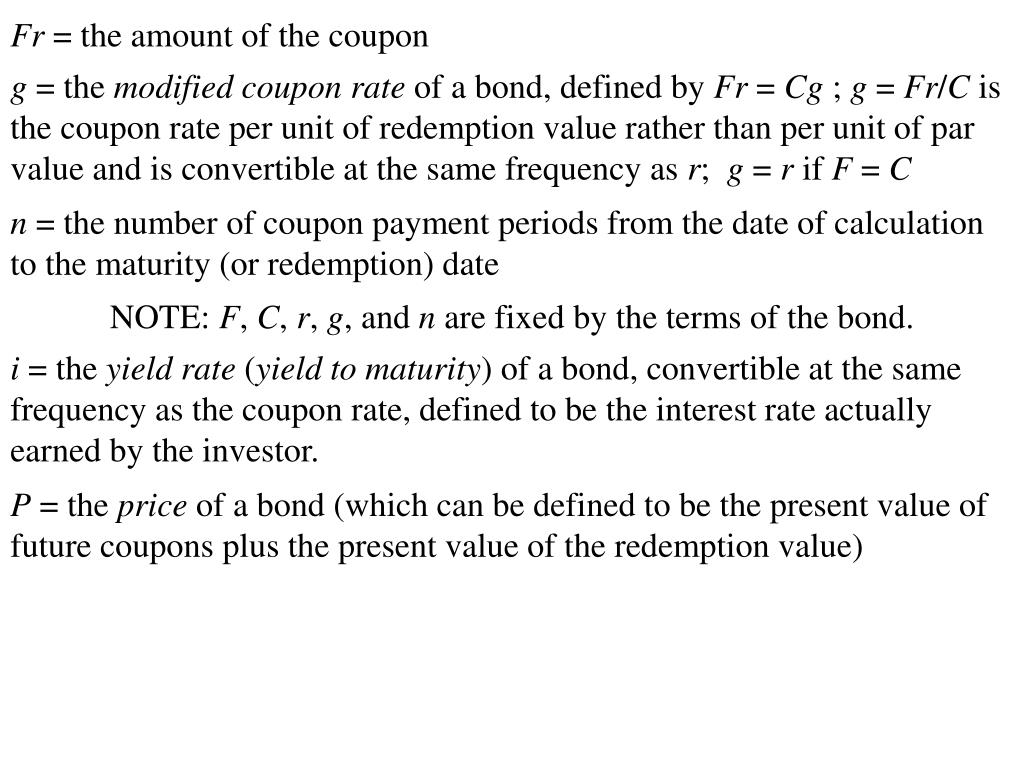

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia Debt instruments don't always trade at face value. If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value...

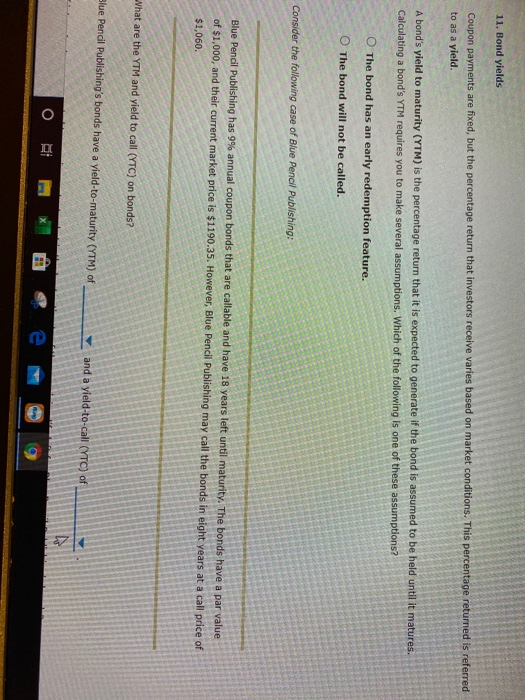

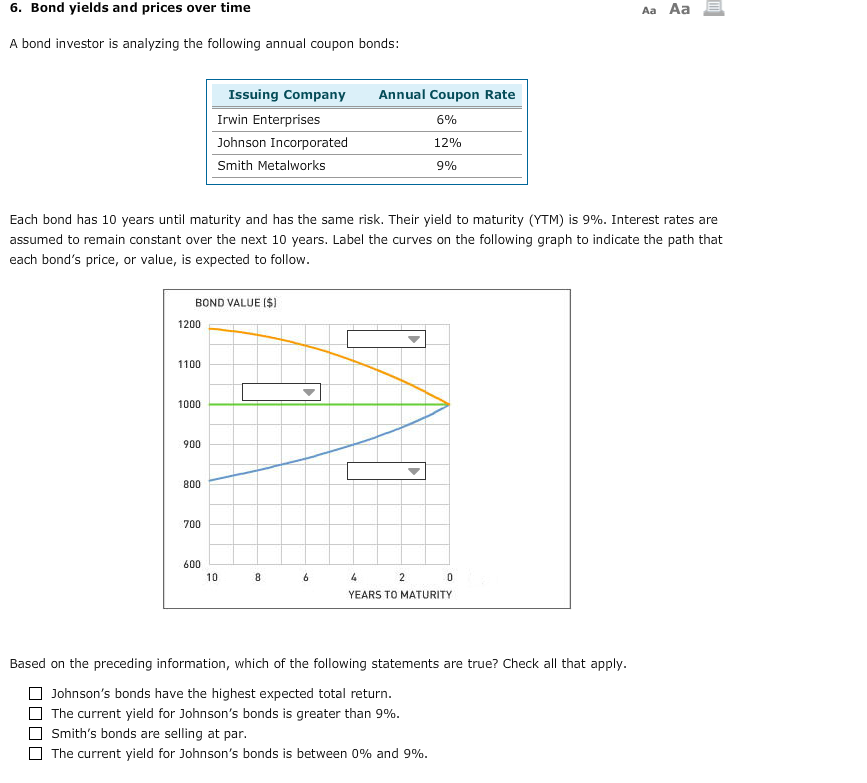

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value.

Bond yield vs coupon rate

Yield to maturity - Wikipedia An ABCXYZ Company bond that matures in one year, has a 5% yearly interest rate (coupon), and has a par value of $100. To sell to a new investor the bond must be priced for a current yield of 5.56%. The annual bond coupon should increase from $5 to $5.56 but the coupon can't change as only the bond price can change. So the bond is priced ... Coupon vs Yield | Top 5 Differences (with Infographics) Key Differences. For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield Calculation Of The Yield The Yield Function in Excel is an in-built financial function to determine the yield on security or bond that pays interest periodically. It calculates bond yield by using the bond's settlement value, maturity, rate, price, and ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Bond yield vs coupon rate. Explaining Yields vs Coupon rate of Bonds - Orb52 But when the Price of the bond fell to ₹9500, then even in such a situation the interest that will be received is still ₹1,000. Hence in such case, the actual returns will be ₹1,000/₹9,500 = 10.52% and this is called the Yield on the Bond. In such case, the decrease in the price resulted in the increasing of the Yield of the Bond. Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: Current Yield: Bond Formula and Calculator [Excel Template] Current Yield = Annual Coupon ÷ Bond Price; For instance, if a corporate bond. Current Yield = $80 Annual Coupon ÷ $970 Bond Price; Current Yield = 8.25%; Current Yield of Discount, Par & Premium Bonds. The difference between the current yield and coupon rate of a bond stems from the pricing of the bond diverging from its par value. Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Coupon Rate Of A Bond Formula Definition Calculate Coupon Rate Value of sum value bond of coupon the face coupon as par dividing amount of of the is also rate rate- be by bond- the be mathematically represented interest 100. Home; News; Technology. All; Coding; Hosting; Yield to Maturity (YTM) Definition & Example | InvestingAnswers 10.03.2021 · Yield to Call vs. Yield to Maturity. Calculating yield to maturity requires an underlying assumption that all interest payments are paid and reinvested at the same rate until the bond reaches maturity. It’s based on the coupon rate, purchase price, years until maturity, and the bond’s face value. Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find ... Bond Coupon Interest Rate: How It Affects Price - Investopedia At $715, the bond's yield is competitive. Conversely, a bond with a coupon rate that's higher than the market rate of interest tends to rise in price. If the general interest rate is 3% but the...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ... Coupon Rate vs Yield for a Bond: Fixed Income 101: Easy Peasy ... - YouTube This video addresses "Coupon Rate vs Yield" for a Bond in a simple, kid-friendly way. PLEASE SUBSCRIBE (It's FREE!): ... What Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) For example, consider a bond with a coupon rate of 2% and another bond with a coupon rate of 4%. Keeping all the features the same, bond with a 2% coupon rate will fall more than the bond with a 4% coupon rate. Maturity affects interest rate risk. The longer the bank's maturity, the higher the chances of it being affected by the changes ...

Understanding Bond Prices and Yields - Investopedia A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. A bond's coupon rate is the periodic distribution the holder receives. Although a bond's coupon...

How are bond yields different from coupon rate? The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the...

Bond Prices, Rates, and Yields - Fidelity Coupon rate—The higher a bond's coupon rate, or interest payment, the higher its yield. That's because each year the bond will pay a higher percentage of its face value as interest. Price—The higher a bond's price, the lower its yield. That's because an investor buying the bond has to pay more for the same return.

When is a bond's coupon rate and yield to maturity the same? - Investopedia The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the...

Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA Coupon Rate or Nominal Yield = Annual Payments / Face Value of the Bond Current Yield = Annual Payments / Market Value of the Bond Zero-Coupon Bonds are the only bond in which no interim payments occur except at maturity along with its face value. Bond's price is calculated by considering several other factors, including: Bond's face value

Post a Comment for "40 bond yield vs coupon rate"