43 zero coupon bonds tax

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. The ABCs of Zero Coupon Bonds | Tax & Wealth Management, LLP Zero coupon bonds are subject to an unusual taxation in which the receipt of interest is imputed each year, requiring holders to pay income taxes on what is called "phantom income." Target Dates For individuals, zero coupon bonds may serve several investment purposes.

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

Zero coupon bonds tax

Zero-Coupon Bonds - Tax Professionals Member Article By Carmen Garcia A zero-coupon bond is a type of fixed income instrument that pays no interest on the principal until maturity. Municipalities and businesses often issue Zero-coupon bonds to make saving for retirement, education, or other purposes more affordable. Zero-Coupon Bond Definition - Investopedia The imputed interest on the bond is subject to income tax, according to the Internal Revenue Service (IRS). Therefore, although no coupon payments are made on zero-coupon bonds until maturity,... How is tax calculated on a zero coupon bond? - Quora The brokerage firm calculates it annually—and reports it on your annual tax statement—by multiplying the cost of the bond ($900) by the Yield to Maturity (5.4%). So, on a 2-year, zero-coupon bond you bought for $900, the imputed interest for this year would be $50. You will pay tax on the $50, whether you actually made $50 or not.

Zero coupon bonds tax. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Zero Coupon Municipal Bonds: Tax Treatment - TheStreet , the tax rules for zero-coupon bonds bought as new issues and held to maturity are fairly simple. Whether the bond is taxable or tax exempt, you have to accrue interest on the bond. That means you... How are zero coupon bonds taxed? - Foley for Senate Zero coupon municipal bonds ("zeros") are tax-exempt, intermediate to long- term bonds purchased at a deep discount and do not make periodic coupon interest payments. Instead, interest compounds semi-annually at a rate specified at purchase. The difference between purchase price and face amount equals this interest. Tax Considerations for Zero Coupon Bonds - Financial Web With a zero coupon bond, you are not paid any interest over the life of the bond. At the end of the bond, you get the face value of the bond. The difference with this type of bond is that you can buy the bond at a serious discount to what its end value is. For example, you may only pay 70 to 80 percent of the value of the bond when you buy it.

The ABCs of Zero Coupon Bonds | Downing Tax & Financial Service The ABCs of Zero Coupon Bonds. At first blush, the idea of a bond that doesn't pay interest seems oxymoronic. After all, isn't a bond a debt instrument that pays periodic interest and repays the principal at maturity? 1 Zero coupon bonds are indeed debt instruments, but are issued at a discount to their face value, make no interest payments, and pay its face value at time of maturity. Section 2(48) Income Tax: Zero Coupon Bonds - CA Club a) Meaning of 'Zero Coupon Bond': Section 2 (48) Income Tax As per Section 2 (48) of Income Tax Act, 1961, unless the context otherwise requires, the term "zero coupon bond" means a bond- (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day of June, 2005; How are Bonds Taxed Under the Income Tax Act? - Wint Wealth There are different types of bonds in the market. Let us look at their types and taxation. 1. Zero-Coupon Bonds. Zero-coupon bondholders are liable to only capital gain tax as they do not provide any interest income. However, these are issued at a discount. Hence, the difference is taxed as capital gain. 2. Understanding Zero Coupon Bonds - Part One - The Balance You buy zero coupon bonds a deep discount to face value. You receive no interest until maturity; however, in most cases, you do owe taxes annually on the interest as it accrues. In Part Two In part two, we'll look more closely at the tax implications of zero coupon bonds and examine how you can use zeros to meet your financial goals.

TAXABILITY OF ZERO COUPON BONDS - The Tax Talk Zero coupon bonds are taxable under two heads depending upon how the bond is held. If the bonds are held as capital asset, these are taxable under the head "Income from Capital Gains". These can be short term or long term depending upon the holding period. i.e. 12 months. Long term Capital gains will be taxable at the rate of 10%+ cess. No PDF Income Taxes on Zero Coupon Bonds (Preliminary Version) the tax free rate to the after tax rate of return is a common comparison in evaluating taxable and tax free investments. A zero coupon bond pays only at maturity and doesn't pay periodic interest. For a taxable zero coupon bond, the IRS requires that income taxes be paid annually as OID securities How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are issued at a minimum face value of $1,000, and the earliest a Treasury zero bond matures is in 10 years. The bond interest income is taxed at the federal level and possibly at the... What is the tax implication on zero coupon bonds? - myITreturn Help Center myITreturn Helpdesk. 5 months ago. Updated. Any long term capital gain on sale of zero coupon bonds shall be charged to tax at minimum of the following: 20% of LTCG After indexation of cost of such bonds or 10% of LTCG before indexation of cost of such bonds. Zero coupon bonds, Investing in Zero Coupon Bonds, Tax Considerations for Zero Coupon ...

Advantages and Risks of Zero Coupon Treasury Bonds If issued by a government entity, the interest generated by a zero-coupon bond is often exempt from federal income tax, and usually from state and local income taxes too. Various local...

MC Explains | What is a 'zero-coupon, zero-principal' instrument? Tags: #80G #donation #MC Explains #SEBI #Securities and Exchange Board of India #Social Stock Exchanges #tax deductible sum #tax deduction #zero coupon bonds. first published: Jul 20, 2022 12:34 pm

How to Invest in Zero-Coupon Bonds - US News Money Zeros are purchased through a broker with access to the bond markets, or with an actively managed mutual fund or and index-style product like an exchange-traded fund. PIMCO 25+ Year Zero Coupon US ...

Tax Considerations for Zero Coupon Bonds - Financial Web Tax Considerations Zero coupon bonds have unique tax implications. Technically, you are earning interest every year, even though you do not see it until the end of the bond term. Therefore, you have to pay the taxes on the interest every single year even though you do not get the interest until the end of the arrangement.

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting This zero-coupon bond was sold for $2,200 below face value to provide interest to the buyer. Payment will be made in two years. The straight-line method simply recognizes interest of $1,100 per year ($2,200/2 years). Figure 14.11 December 31, Years One and Two—Interest on Zero-Coupon Bond at 6 Percent Rate—Straight-Line Method

Taxes and zero coupon bonds - FMSbonds.com Tax-exempt interest earned on zero coupon bonds should be reported on your 1040, along with all other tax-exempt interest received. The interest reported is based on the original issue price and yield or, as you stated, "the bond's original accretion." Your adjusted basis in the bonds at any time after purchase would be your actual purchase ...

Impact of Taxation on Zero-Coupon Muni Returns Taxation on zero-coupon munis is only realized upon their sale or maturity. If the bond is sold before its maturity, it is either sold at a discount or a premium in the secondary market. Any price paid above the adjusted issue price (discussed below) will be premium and any price below the adjusted issue price will be discount.

Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing Tips With a zero-coupon bond, you buy the bond at a discount from its face value, don't receive interest payments during the bond's term, and are paid the bond's face amount when it matures. For...

Zero Coupon Bonds- Taxability under Income Tax Act, 1961 According to this proviso, tax on long term capital gain on zero coupon bonds shall be lower of the following: - (a) Tax on capital gains computed normally @ 20% on difference of maturity price and purchase price (indexed) or

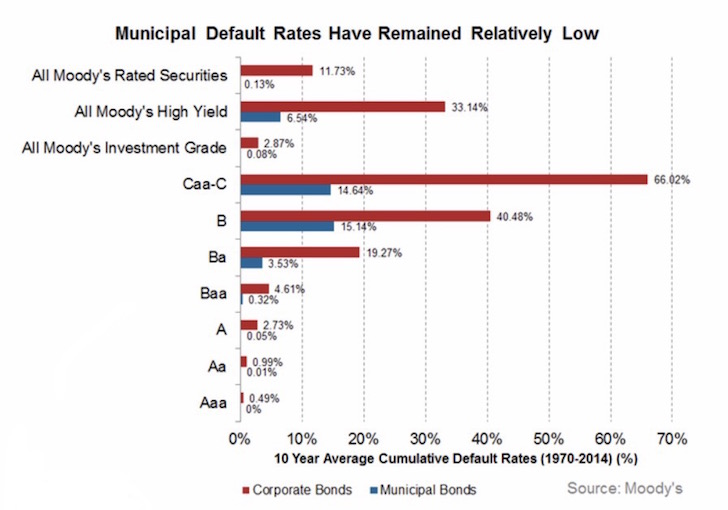

Investor's Guide to Zero-Coupon Municipal Bonds - Project Invested Zero-coupon bonds are sold at a substantial discount from the face value. For example, a bond with a face value of $20,000, maturing in 20 years with a 5.5% coupon, may be purchased at issuance for roughly $6,757. At the end of the 20-year investment, the investor will receive the full $20,000 face value.

How is tax calculated on a zero coupon bond? - Quora The brokerage firm calculates it annually—and reports it on your annual tax statement—by multiplying the cost of the bond ($900) by the Yield to Maturity (5.4%). So, on a 2-year, zero-coupon bond you bought for $900, the imputed interest for this year would be $50. You will pay tax on the $50, whether you actually made $50 or not.

Zero-Coupon Bond Definition - Investopedia The imputed interest on the bond is subject to income tax, according to the Internal Revenue Service (IRS). Therefore, although no coupon payments are made on zero-coupon bonds until maturity,...

Zero-Coupon Bonds - Tax Professionals Member Article By Carmen Garcia A zero-coupon bond is a type of fixed income instrument that pays no interest on the principal until maturity. Municipalities and businesses often issue Zero-coupon bonds to make saving for retirement, education, or other purposes more affordable.

Post a Comment for "43 zero coupon bonds tax"